arkansas inheritance tax laws

However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without a valid will. The federal government does not impose an.

Arkansas Inheritance Laws What You Should Know

1 a life estate in one-third.

. Arkansas does not collect an estate tax or an inheritance tax. Arkansas does not have an inheritance tax. The inheritance laws of another.

Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who. However residents of Arkansas will. Arkansas does not collect inheritance tax.

Arkansas does not collect inheritance tax. Arkansas also has no inheritance tax. Below is a brief overview of the dower and curtesy rules under Arkansas law.

This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax. Interests transmissible by inheritance. A Heirs may inherit every right title and interest not terminated by the intestates death in real or personal property.

Arkansas does not collect an estate tax or an inheritance tax. Arkansas Probate and Estate Tax Laws. Laws arkansas does not collect an estate tax or an inheritance tax.

Inheritance laws of other states may apply to you though if you inherit money or assets from. Arkansas does not have a state inheritance or estate tax. This article covers probate how to successfully create a valid will in Arkansas and what.

There are two types of taxes that may be assessed upon an estate at the state level. All Major Categories Covered. The rest goes to other surviving relatives in the order established by.

A 1 Heirs will take per stirpes if the intestate is predeceased by one 1 or more persons who would have been entitled to inherit from the intestate had such. Arkansas Inheritance and Gift Tax. In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely.

Sarah FisherFeb 23 2022. The State of Arkansas cannot tax your inheritance. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a.

In 2022 Connecticut estate taxes will range from 116 to 12. However if you are inheriting property from another state that state may have an estate tax that applies. Unlike most states in which.

Ashley County AR Probate. Select Popular Legal Forms Packages of Any Category. There are only seven states that have an inheritance tax.

Arkansas intestacy laws dictate that the parents of a decedent receive a share of their childs assets. Up to 25 cash back If you were married for less than three years your spouse inherits 50 of your intestate property. However if you are inheriting property from another state that state may have an estate tax that applies.

The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. February 25 2021 By Milligan Law Offices. - 941 - - - aa_probate_redirect - 2021-08-06 - 2021-12-16 161836 - Select Author Probate filing fees phone numbers addresses of your local probate court.

Even though Arkansas does not collect an inheritance tax however you could end up. Arkansas Intestacy Laws 28-9-206. Decedent survived by spouse and one or more childrenthe spouse is endowed with.

Ad Instant Download and Complete your Will Forms Start Now. For example if a decedent was married less than three years and has no children his. State estate taxes are similar to federal taxes because they are.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. In Arkansas probate is the court process of estate administration by which property is devised by will or distributed through laws of intestacy to the decedents rightful. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

When a person does not leave a will naming beneficiaries to inherit his estate Arkansas intestacy laws set forth the order in which his heirs have a right to inherit. The process however can take longer for contested estates. It is one of 38 states that does not apply a tax at the state level.

Inheritance Laws in Arkansas.

Is There A Federal Inheritance Tax Legalzoom Com

Arkansas Inheritance Laws What You Should Know

How Is Tax Liability Calculated Common Tax Questions Answered

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Digital Estate Plan With Legacy Assurance Plan For More Information Https Legacyassuranceplan Wordpr Estate Planning Checklist Estate Planning How To Plan

How Do State And Local Sales Taxes Work Tax Policy Center

State Income Tax Understanding How Arkansas Texas And Surrounding States Impact Retirement Income Brownlee Wealth Management

Tax Burden By State 2022 State And Local Taxes Tax Foundation

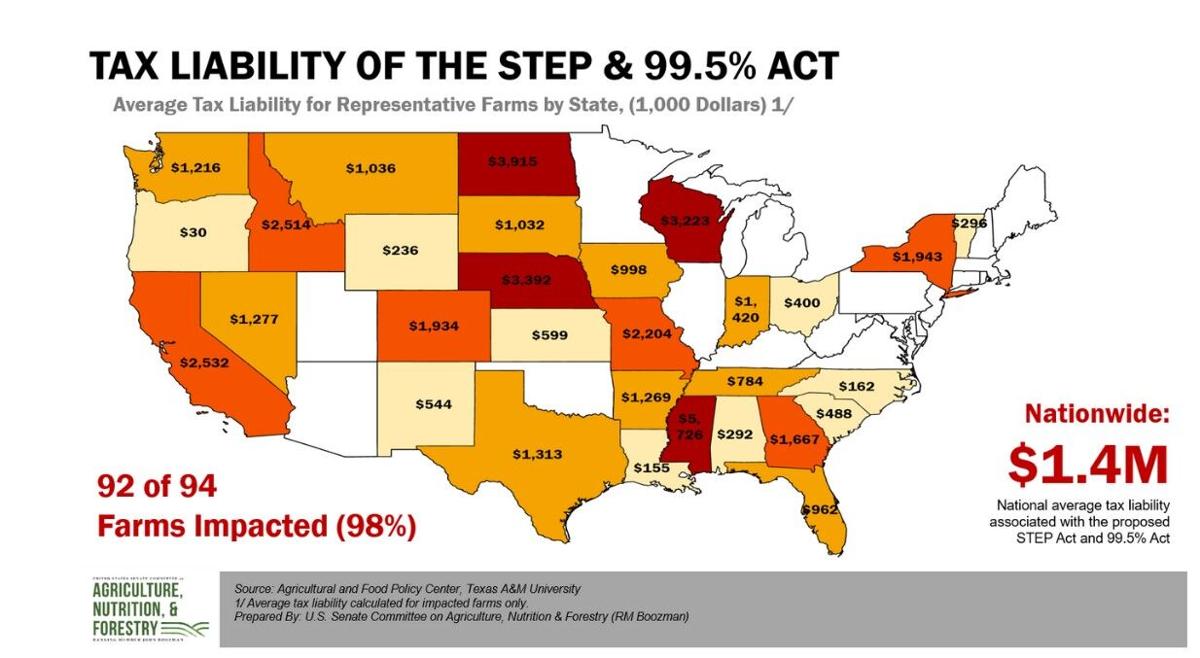

Texas A M Study Analyzes The Impact Of Inheritance Tax Code Changes On Farmers National Farmweeknow Com

Get Our Example Of Small Business Security Plan Template For Free Startup Business Plan Template Business Plan Template Business Plan Template Free

Arkansas Inheritance Laws What You Should Know

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Is There An Inheritance Tax In Arkansas

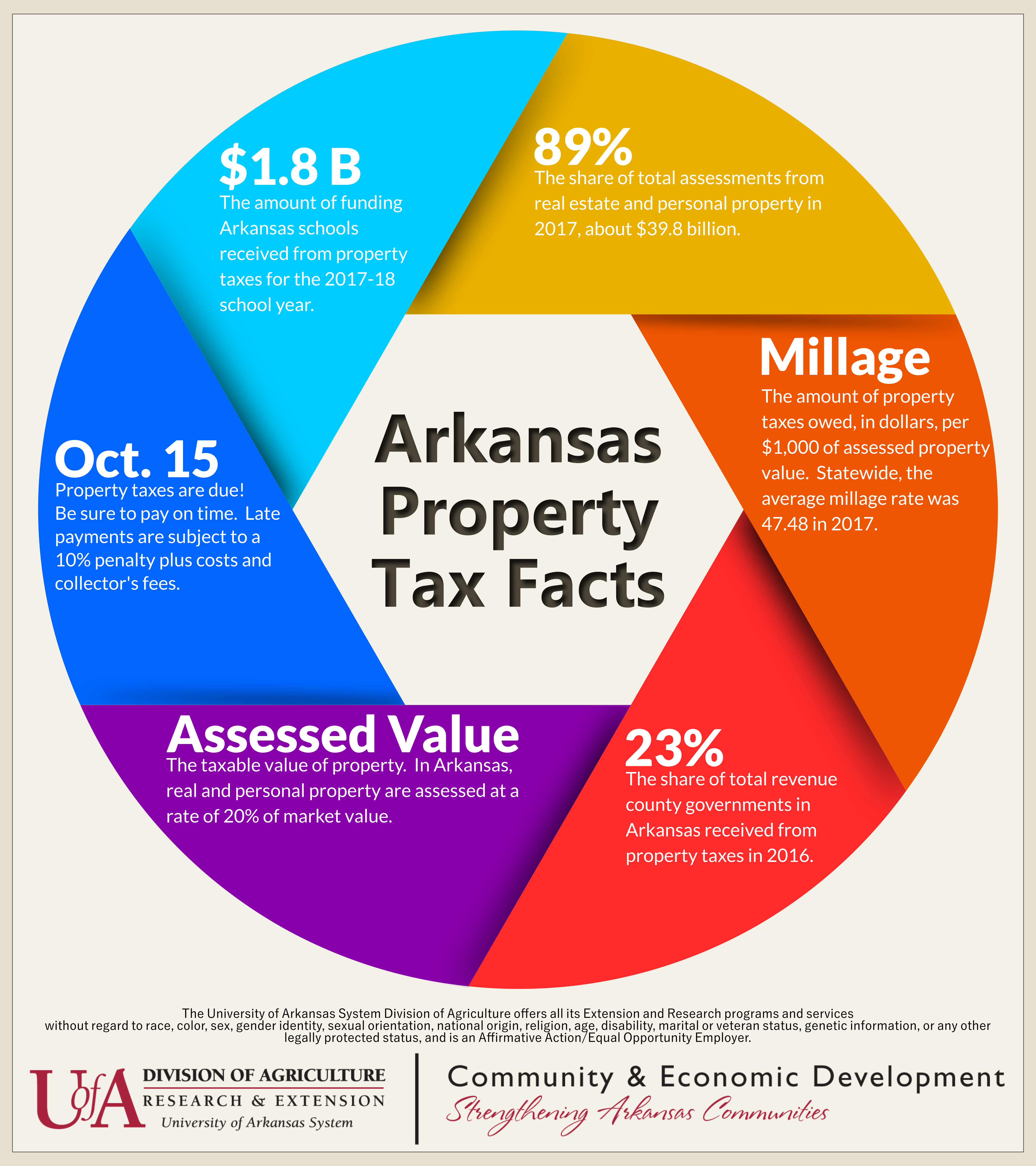

Property Tax Comparison By State For Cross State Businesses

Arkansas Inheritance Laws What You Should Know

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62